As a travel nurse, you may be required to file taxes in multiple states, which can make the process complex and time-consuming. However, with the right tax software, you can streamline the process and ensure that you’re getting all of the deductions and credits that you’re entitled to.

In this comprehensive guide, we’ll take a deep dive into the best tax software for travel nurses. We’ll cover everything from the importance of selecting the right software to factors to consider when making your decision.

So whether you’re a seasoned pro or a first-time filer, read on to find out which tax software is right for you.

Factors to Consider When Choosing Tax Software

For travel nurses, choosing the right tax software can be very daunting. There are several factors to consider when selecting tax software that best suits your needs. Let’s go take a look at them:

Deductions and Credits for Travel Nurses

One of the most important factors is the availability of deductions and credits that are specific to your profession. Travel nurses may be eligible for tax deductions and credits such as travel expenses, licensure fees, and continuing education costs. The use of tax software designed for travel nurses can help identify all eligible deductions and credits.

Multi-State Tax Preparation

Another key factor to consider is the multi-state tax preparation. Since travel nurses often work in multiple states, it’s crucial to choose tax software that can handle this complexity.

Some tax software options offer features specifically designed for travel nurses, such as the ability to allocate income and deductions between different states.

It’s also important to ensure that the tax software you choose is up-to-date with the latest tax laws and regulations for all the states you work in. In addition, consider whether or not the tax software offers customer support or access to tax professionals who can answer any questions you have about multi-state taxation.

Accessible Customer Support

Accessible customer support is another factor that some travel nurses may overlook. Look for software providers that offer reliable and easily accessible customer support through phone, email or live chat. During peak tax season, having easily accessible customer support provides peace of mind and helps you get timely answers to your questions and concerns.

Furthermore, it’s advisable to read reviews from other users about the quality and responsiveness of the provider’s customer support before making a decision. Having reliable and accessible customer support can save you time and stress during tax season and ensure that you’re confident in filing your taxes correctly.

Top Picks Between the Softwares for Travel Nurses

TurboTax

For most travel nurses, TurboTax is the best option for tax software. It is designed to guide users through the tax-filing process step-by-step, making it easy to use.

TurboTax offers a variety of options, including free filing for simple returns and premium packages for more complex situations. The software helps travel nurses navigate unique tax deductions and credits that they may qualify for. Additionally, TurboTax provides users with audit support and guarantees the accuracy of its calculations.

TurboTax can also import information from previous tax years and integrate with popular accounting software programs, making it a convenient choice for busy travel nurses who want to easily keep track of their finances. With its user-friendly interface and comprehensive features, TurboTax is an excellent pick for travel nurses looking to file their taxes quickly and accurately.

Pricing and Packages of TurboTax

TurboTax offers several packages to choose from, including Free Edition, Deluxe, Premier, and Self-Employed. The pricing of each package varies based on your individual tax situation.

Travel nurses may benefit from the Premier or Self-Employed packages, which include additional features for rental properties and business expenses. TurboTax also offers a free version for simple tax returns, making it an affordable option for those on a budget.

In addition to its pricing options, TurboTax’s user-friendly interface and expert guidance make it a popular choice. Overall, TurboTax offers great value and flexibility for travel nurses looking to file their taxes with ease.

H&R Block

While it isn’t the top-rated software, H&R Block is a popular pick due to its user-friendly interface and ease of navigation. The software comes with helpful prompts and tips that maximize tax deductions and credits, making it an excellent choice for individuals on a budget.

H&R Block offers various versions of the software that cater to different budgets and needs. Data security is also among the company’s top priorities, so users can feel safe entrusting their sensitive information. Additionally, H&R Block provides customers with chat, email, phone and in-person support options to assist with any queries about tax filings.

Pricing and Packages of H&R Block

Depending on their tax needs, travel nurses can choose from different packages. The basic package includes federal and state tax returns, while the premium package includes additional features such as investment income and rental property deductions.

H&R Block also offers a free online tax filing option for simple tax returns. For those who need more personalized assistance, H&R Block has tax experts who can provide guidance and advice. All of these factors contribute to making H&R Block a reliable and cost-effective option for travel nurses looking for quality tax software.

Credit Karma Tax

Credit Karma Tax is an excellent option for travel nurses who want to file their taxes without any added expense. This tax software allows for easy import of W-2s, 1099s, and other necessary tax documents. It also offers a step-by-step guide to help you navigate the tax filing process successfully. Credit Karma Tax provides free audit defense as well.

However, it may not be suitable for complex tax situations or those with multiple state filings. Before choosing this software, make sure to check if it meets your requirements..

Pricing and Packages of Credit Karma Tax

The platform offers a straightforward and user-friendly interface that guides users through the process of filing both federal and state taxes, with no hidden fees or charges.

In addition to the free option, Credit Karma Tax also offers paid packages for those with more complex tax situations. The pricing for these packages is competitive compared to other tax software options in the market, making it an affordable choice for travel nurses looking for a reliable tax software solution.

With several different package options to choose from, travel nurses can select the one that best fits their specific tax needs and budget. Overall, Credit Karma Tax provides an excellent value for its users, offering useful features and helpful guidance throughout the entire tax filing process.

Other Contenders to Consider

Apart from the aforementioned tax software options, there are several other contenders to consider for travel nurses. Here are a couple more of them:

TaxSlayer

This user-friendly software offers a variety of features, including the ability to file both federal and state taxes, as well as a range of deductions to help maximize your refund. TaxSlayer also provides customer support through various channels such as phone, email, and live chat to assist with any questions you may have.

In addition, TaxSlayer is affordable and offers various pricing plans to fit different budgets. All in all, it is an excellent option for travel nurses who want straightforward tax preparation software that can help them navigate the complexities of tax season easily.

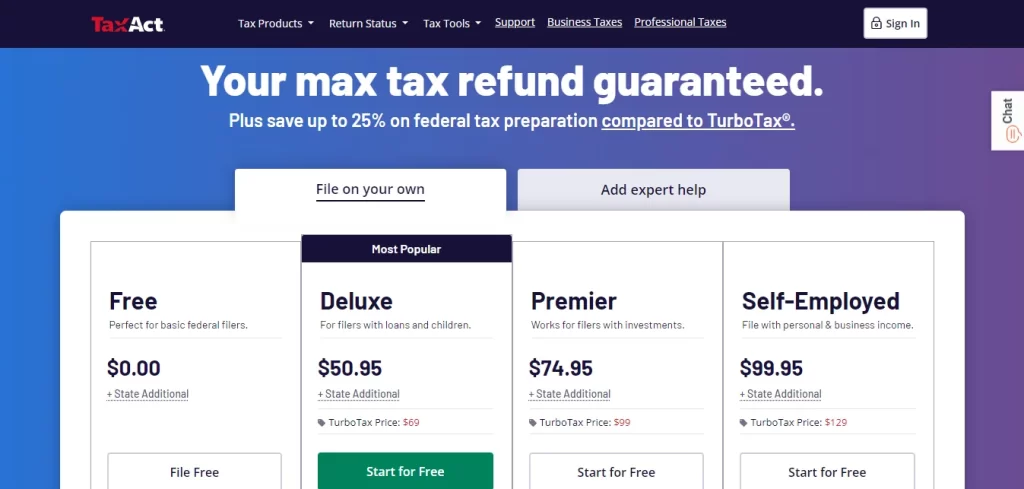

TaxAct

TaxAct is another popular option with several features that can greatly benefit travel nurses. It provides step-by-step guidance for filing taxes and has error-checking tools to ensure accuracy. The software also offers free federal and state e-filing, making it an affordable option for those on a budget.

Additionally, TaxAct is compatible with a variety of devices, including desktops, laptops, and mobile phones, making it easily accessible for travel nurses who are constantly on the move.

In summary, TaxAct is a user-friendly option that can help travel nurses file their taxes in a quick and efficient manner.

Read more: Top 10 Travel Nurse Benefits.

Conclusion

Choosing the right or best tax software for travel nurses is crucial to ensure maximizing deductions and credits while filing taxes. Each of these tax software options has its unique features and benefits, pricing packages, and factors to keep in mind before making a decision.

Whether it’s accessibility to customer support or multi-state tax preparation, our guide covers all the necessary considerations a travel nurse will have to make when choosing the most suitable tax software. If you’re a travel nurse by profession, we sincerely hope this blog post will now help you to make an informed decision.

FAQ

How does a tax software help travel nurses?

Tax software can be a valuable tool for travel nurses who are looking to simplify and streamline their tax preparation process.

Which is the best tax software for travel nurses?

Some of the most popular tax software programs used by travel nurses include TurboTax, H&R Block, and TaxAct.

Which is the best free tax software for travel nurses?

Some of the most popular free tax software options for travel nurses include TurboTax Free Edition, H&R Block Free Online, and TaxAct Free Edition. These programs all offer basic tax preparation services at no cost, including support for common tax forms and deductions.

Leave a Reply